Family health insurance quotes are price estimates based on your ZIP code, ages, tobacco use, plan level, and who you cover.

The best quote is rarely the lowest monthly price. A smarter pick is the plan with the best total cost for your family (premium + deductible + out-of-pocket max) and a network that includes your doctors.

Choosing a plan with the best overall value means you can keep $2,000 more in your pocket, potentially for unforgettable experiences like that family summer camp. It’s about ensuring that every dollar spent on insurance counts towards meaningful benefits.

I know you want family health insurance quotes that make sense. You do not want 150 calls. You do not want your number passed around like a free sample at Costco.

This guide keeps it simple and practical. You will learn the 3 numbers that matter most. You will also learn what to verify so the “cheap” quote does not turn into a nasty surprise later.

What is a family health insurance quote, and what does it include?

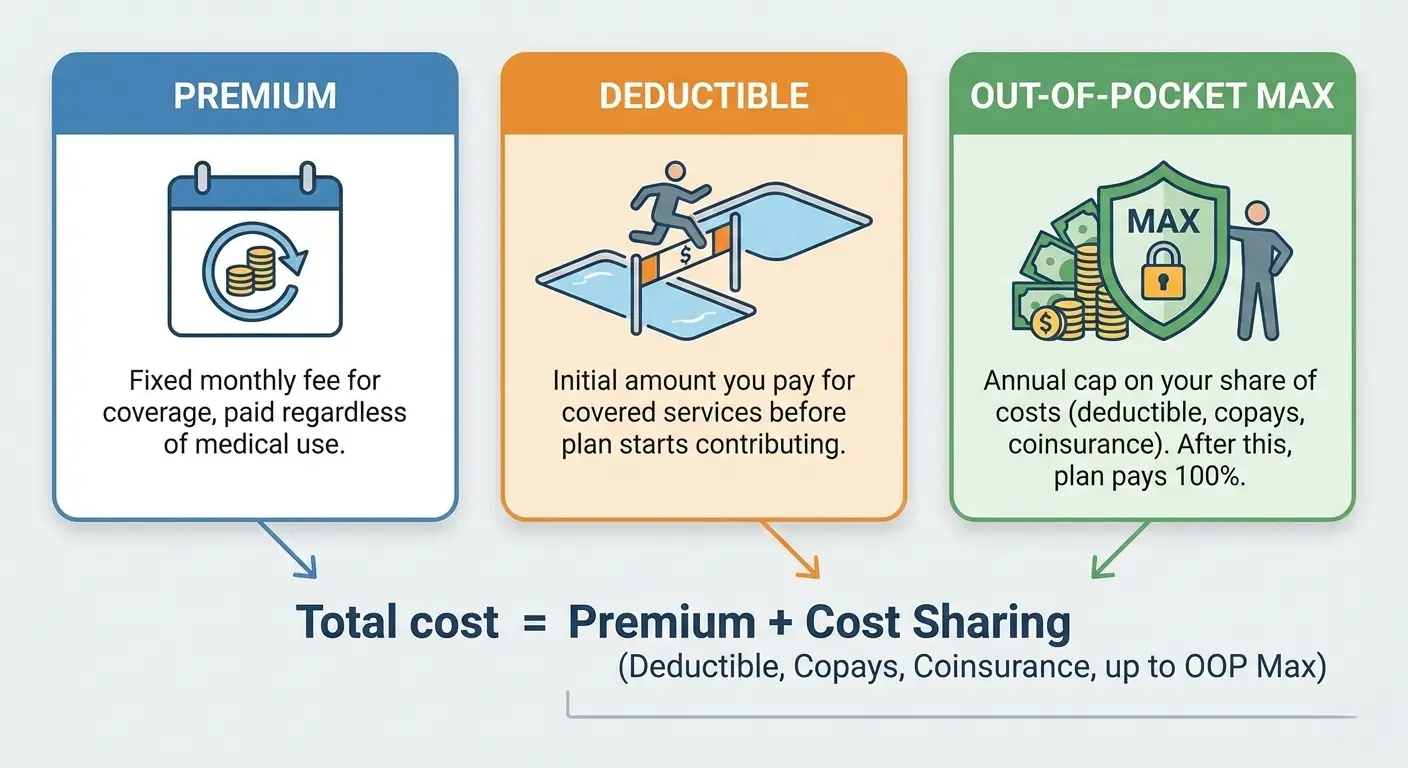

A family health insurance quote is a price estimate for covering your household. It usually shows the monthly premium and key costs, such as deductibles, copays, and an out-of-pocket maximum.

A quote is a starting point, & not a promise. It uses your basic details and estimates what you may pay. HealthCare.gov defines a premium as the amount you pay every month.

It defines a deductible as the amount you pay for covered services before the plan starts to pay (depending on the plan).

A usable quote should show:

- Monthly premium (is in your monthly bill)

- Deductible (is what you pay first for many services)

- Copay / coinsurance (is what you pay when you use care)

- Out-of-pocket max (is your worst-case cap for covered in-network services, which depends on the plan)

Quick “quote decode” table:

| Premium | Monthly cost to keep the plan | Impacts your monthly budget |

| Deductible | What you pay before many benefits help | Impacts early-year spending |

| Copay/Coinsurance | Your share when you get care | Impacts visit and ER costs |

| Out-of-pocket max | Max you pay for covered in-network care (plan rules apply) | Limits worst-case risk |

The plan rules and prices vary by state and insurer, so always confirm details in the plan’s official documents, like the Summary of Benefits and Coverage (SBC).

How do family health insurance quotes work?

Quotes work by using your basic details to estimate the monthly price. Then the plan’s cost-sharing rules decide what you pay when you use care.

HealthCare.gov says five factors can affect a plan’s monthly premium: location, age, tobacco use, plan category, and whether the plan covers dependents.

While some of these factors, such as age and location, are beyond your control, you can influence others.

For example, avoiding tobacco use not only benefits your health but can also lower your premium. Likewise, choosing a plan category that aligns with your family’s health needs can optimize your health insurance costs.

Distinguishing between these immutable and controllable factors empowers you to make informed decisions and take charge of your health insurance costs.

Most quote forms ask for:

- ZIP code (or county)

- The ages of each person

- Tobacco use (if asked)

- Who you cover (spouse, kids)

- A plan level (often Bronze, Silver, Gold, Platinum)

Then your real cost comes from two buckets:

- What you pay every month (premium)

- What you pay when you use care (deductible, copays, coinsurance), up to your out-of-pocket max

HealthCare.gov also explains that plan categories (“metal levels”) are about how you and the plan split costs, not quality.

A quote is not a guarantee. Final rates and eligibility can change after enrollment review and plan rules.

How to get family health insurance quotes without getting spam calls?

To avoid spam calls, start with official sources and carriers. Don’t share your phone number until you trust the person asking and know why they’re asking.

Many “comparison” sites are lead generators. You submit one form, and your contact info may get shared. That is why people feel the lead bomb.

Safer ways to start:

- Use a carrier’s own quote tool if you want a quick starting price.

- If you want help, you can choose a broker you trust, like Custom Health Plans. They can help you compare plans and explain the numbers.

- We don’t spam and keep everything clean & professional.

Prices and benefits depend on the plan, so always confirm details in the SBC/EOC and provider network before you enroll.

Are online family health insurance quotes accurate?

Online quotes can be accurate for base pricing, but they can miss real costs if networks, prescriptions, or rules don’t match your family.

Online family health insurance quotes are best as a “starting range.” They work best when your inputs are correct, and the site is pulling real plan data.

Accuracy depends on:

- Correct ZIP code and ages

- Correct household size

- Correct income estimate (if checking “after savings” pricing)

- Checking doctors, hospitals, and prescriptions

- Seeing deductible and out-of-pocket max, not just premium

We recommend comparing total costs, not premiums alone.

Always confirm final details in the plan’s SBC and provider directory before you enroll.

How to verify quote accuracy:

- Match the plan name and network name across the quote and the SBC.

- Confirm doctors and hospitals in the provider directory.

- Check prescriptions on the plan’s drug list (formulary).

- Confirm deductible and out-of-pocket max in the SBC.

How to compare family health insurance quotes the smart way?

Compare quotes by total cost, not monthly price. Use the 3-number rule: premium, deductible, and out-of-pocket maximum.

Here’s the 2-minute framework to compare family insurance quotes without overthinking it.

Step 1: Compare the three numbers:

- Premium (monthly)

- Deductible (what you pay first for many services)

- Out-of-pocket max (cap on what you pay for covered in-network services, depends on plan).

Step 2: Check the “fit” items:

- Doctors (primary and kids)

- Hospital and urgent care

- Labs and imaging (easy surprise spot)

- Prescriptions (formulary)

Step 3: Look at “bad year” protection: Your total costs include the premium plus out-of-pocket costs such as deductibles, copays, and coinsurance.

A lower premium plan can be fine, but only if the deductible and network still work for your family’s real needs.

How much are family health insurance quotes per month?

Family health insurance quotes per month vary in many ways. ZIP code, ages, plan level, and premium tax credit eligibility can change your price fast.

People want a clean price. But the market does not care; prices change based on your details.

A safer way to estimate family health insurance quotes without guessing:

- Pull quotes for the family.

- Compare “before savings” and “after savings,” if shown.

- Write down premium, deductible, and out-of-pocket max.

- Decide if you want a lower monthly cost or lower risk in a bad year.

If you are checking savings, remember the premium tax credit is based on household info and estimated income.

Any “average cost” you see online may not match your family’s, so treat it as a starting point and verify it with your exact ZIP code and household details.

Why are family health insurance quotes so high?

Quotes look high when you see full-price premiums, savings change, or you pick plans with lower deductibles. A higher quote may also mean lower cost-sharing when you use care.

Sticker shock usually happens for a few simple reasons:

- You’re seeing full price (no savings applied).

- You’re comparing different plan categories (Bronze vs Gold).

- Prices vary by area because location is a premium factor.

Here’s a real 2026 detail you can use for context: HealthCare.gov lists the 2026 Marketplace out-of-pocket limit as $10,600 for an individual and $21,200 for a family.

What you can do today:

- Compare more than one plan category.

- Check if you qualify for savings (premium tax credit).

- Re-check networks and prescription lists.

- Read the SBC so you know what you’re buying.

Premium changes depend on your state and plan options, so compare new quotes during open enrollment or after a qualifying life event.

Could a subsidy lower your family’s quote, and could you owe money back?

A premium tax credit can lower your monthly premium, but if your income changes, you may have to repay part of it at tax time.

HealthCare.gov says the only way to get the premium tax credit is through the Marketplace.

It also warns that if you use more credit than you qualify for based on your final yearly income, you must pay the difference when you file taxes.

The IRS explains that Form 8962 is used to figure the Premium Tax Credit and to reconcile it with any advance payments of the Premium Tax Credit (APTC).

What helps reduce surprise:

- Report income and household changes quickly.

- Keep Marketplace notices.

- Keep Form 1095-A.

- Reconcile APTC using Form 8962.

This is not tax advice. If your income is changing or you’re unsure about repayment risk, talk with a qualified tax professional.

How to check subsidy + repayment risk:

- Confirm you enrolled through the Marketplace (not off-Marketplace).

- Keep Form 1095-A and use it for Form 8962.

- Report changes in your Marketplace account.

- Save notices showing your updates.

Are family health insurance quotes free, and what’s the catch?

Many quotes are free, but some sites trade your contact info for calls. A free quote is only safe if you control who contacts you.

Many places offer free health insurance quotes for family shopping:

- HealthCare.gov (and state Marketplaces)

- Insurers

- Many agents and brokers

The catch is often marketing:

- Some sites may share or sell leads.

- Some force a phone number before showing a price.

- Some make it hard to stop contact.

A safer approach:

- Start with official sources or carriers.

- Read the privacy policy.

- Use email-first contact.

- Leave if the site feels pushy.

If a site won’t show any estimate without your phone number, it’s okay to use a safer path.

Marketplace vs private plans, which usually saves a family more?

The Marketplace is the only place you can get the premium tax credit. Private plans may work for some families, but savings and options vary by state and county.

Marketplace (buy-your-own plan through the Marketplace):

- Possible premium tax credits (only through the Marketplace).

- Standard plan categories help comparisons.

Off-Marketplace (buy-your-own plan directly):

- No premium tax credit through that channel.

- Plan designs and availability vary.

Job plan (employer plan):

- The employer may pay part of the premium.

- Networks and benefits vary by plan.

| Marketplace | You might qualify for a tax credit | Must apply and update info |

| Off-Marketplace | You want a direct purchase route | No premium tax credit there |

| Job plan | Employer contributes | Plan choices may be limited |

Plan availability varies by county and year, so confirm your options by ZIP code before deciding.

How to check if you enroll with Marketplace vs private:

- Ask: “Is this plan through the Marketplace?”

- If you want savings, confirm you are applying through the Marketplace.

- Compare the same plan category (Bronze/Silver/Gold) when possible.

- Use the SBC to confirm deductible and out-of-pocket max.

What’s the biggest mistake families make with “cheap” quotes?

The biggest mistake is choosing the lowest premium without checking the deductible and out-of-pocket maximum. That “cheap” plan can cost more later.

Low premium does not equal low cost. It means low monthly cost.

Use this simple “use level” test:

- Low use: rare visits, few meds

- Medium use: a few visits, maybe a specialist

- High use: ongoing care, frequent meds, planned procedures

Then match the plan:

- If you expect more care, a slightly higher premium may lower total cost.

- If you expect low care, a higher deductible may be fine if you can handle risk.

- Use the out-of-pocket max as your worst-case safety rail.

The total costs include the premium and out-of-pocket expenses, such as deductibles and copays.

The right plan depends on how your family uses care, so compare plans for your real year, not your best-case year.

Cheap quote reality check:

- Confirm if office visits have copays before the deductible.

- Confirm if prescriptions have a separate deductible.

- Confirm what counts toward the out-of-pocket max (plan rules apply).

- Ask: “Could we pay the deductible if something happens?”

What should you check in the network to avoid surprise bills?

Always check the provider network, hospitals, and labs. A plan can look fine until one service is out-of-network and you get a surprise bill.

The “phantom network” problem happens when part of your care is out-of-network, even at an in-network facility.

The No Surprises Act may protect you in certain situations, like many emergency services and some non-emergency services at in-network facilities, depending on the facts.

Before you enroll, check:

- Your primary doctor and your kids’ doctor

- Your preferred hospital

- Labs and imaging centers you might use

- ER and urgent care rules

- Any planned specialists

If you can, get it in writing:

- Ask the provider’s office which labs they use.

- Ask for the plan’s network name, not just the insurer name.

Surprise billing rules are detailed and situation-specific, so confirm networks in writing and ask for estimates when possible.

Verify network check in 60 seconds:

- Look up each doctor in the plan’s provider directory.

- Confirm the hospital and ER are in-network.

- Ask: “Which lab processes our tests, and is it in-network?”

- Save screenshots of directory results.

Conclusion

Family health insurance quotes get easier when you stop chasing the lowest premium and start comparing total cost.

Use the 3-number rule: premium, deductible, and out-of-pocket max. Avoid lead-bomb quote sites until you decide who you trust.

Verify the network, including labs.

If you use a premium tax credit, keep your info updated and reconcile at tax time.

If you want help, email us for family health insurance quotes.